Question 3

The intention of the government in creating the price floor is to assist the producers of the good.

Question 5

- Consumer surplus: the difference between the buyer's willingness to pay versus what he actually pays

Question 15

The source of inequality

Discrimination in employment

Differences in personal motivation

Differences in educational level attained

Differences in abilities

Progressive income taxes are a way to correct income inequality

Question 38

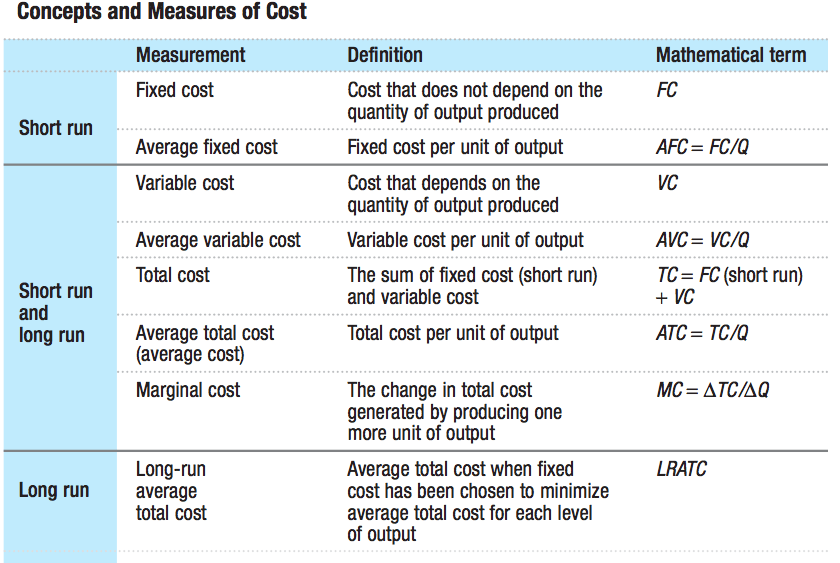

There are economies of scale when long-run average total cost declines as output increases.

There are diseconomies of scale when long-run average total cost increases as output increases.

There are increasing returns to scale when output increases more than in proportion to an increase in all inputs.

There are decreasing returns to scale when output increases less than in proportion to an increase in all inputs.

There are constant returns to scale when output increases directly in proportion to an increase in all inputs.

Question 57

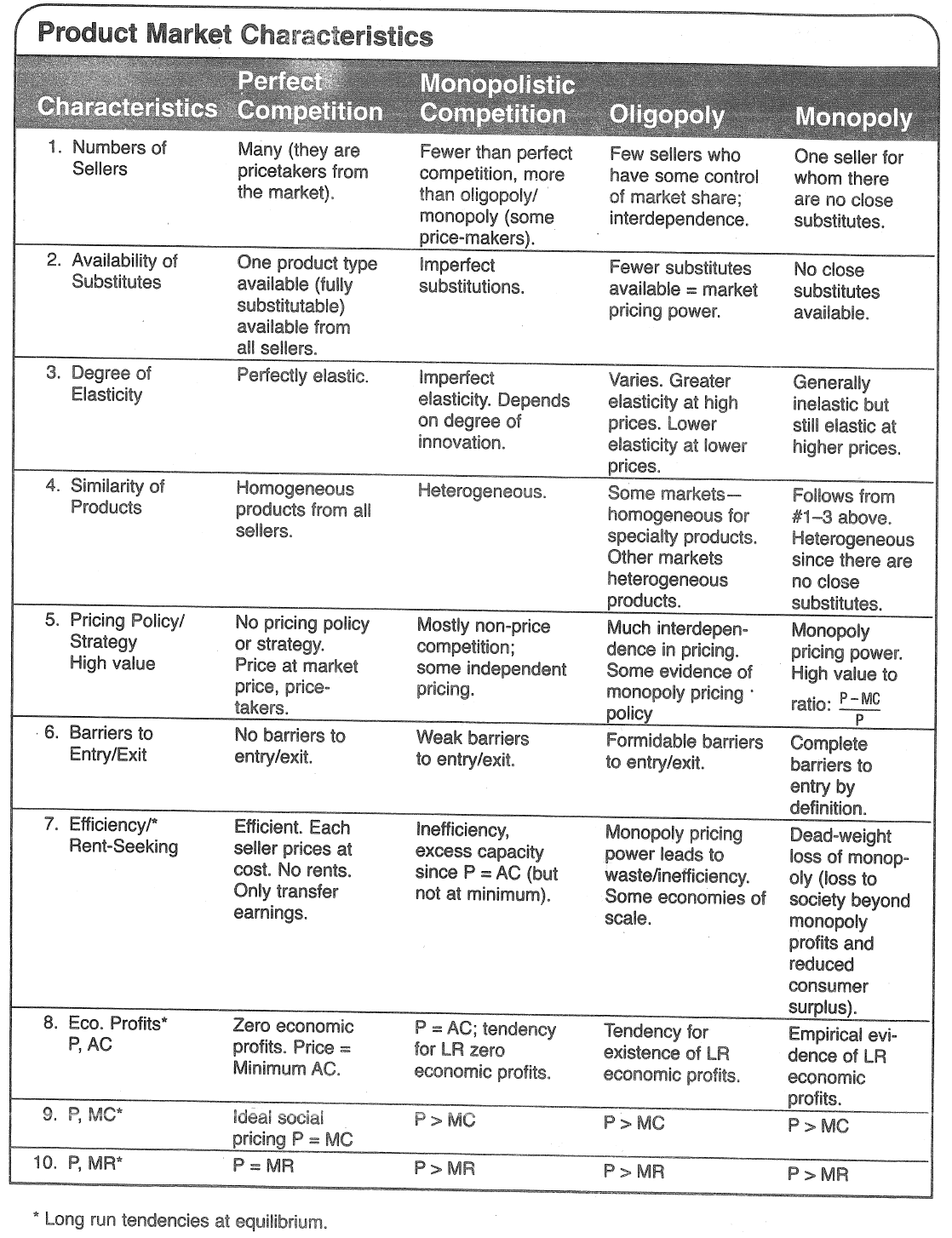

No economic profit in the long run for Perfect Competition and Monopolistic Competition

Question 58

MRP = P * MPL

MRP: Marginal Revenue Product

MPL: Marginal Product of Labor